It is not uncommon for the buyer of a new house to be given a…

Buying a first home? 3 new tips to follow so you won’t miss anything!

So it’s official, you’ve decided to buy your first house. Beware! It is easy to get carried away by the sheer excitement of the moment, but much more difficult to stop and rationally assess the situation. And that’s when bad decisions and problems occur. Read our article to discover 3 tips that will help you make the right choice and act as an experienced buyer during your very first real estate transaction.

Doubts about your next home?

Contact our home inspection service

CAA recommended and make sure you make an informed choice

- Control your emotions

When buying a house, it is important not to let our emotions influence our judgment. It’s quite possible that you’ll experience love at first sight while visiting a house. That’s it, it is the house of your dreams, you are already visualizing yourself living there. In such a situation, our cognitive abilities too often step aside and let our emotions take over. It is important to remember that you are in a real estate transaction and that listening to your emotions can be detrimental during bargaining or when interpreting the issues raised during the pre-purchase inspection. Ideally, it is best to visit several houses before making your choice and to be accompanied by a person who is not emotionally involved in the transaction. His neutral point of view can bring out revealing elements that might otherwise elude you.

- Keep in mind that a home is an investment.

For most of us, buying a house is the biggest investment of a lifetime… but for it to be, one must act as an investor. For it to be a good investment, the price you will get for the eventual resale of your home has to bring in an acceptable profit margin compared to the price you originally paid for it plus the cost of the renovations you made. For example, if the price of the house added to the cost of your planned upgrades totals an amount that remains under the current market evaluation, the transaction just might be a good move. To the opposite case, if one buys a house above its market value just because we are in love with it, the investment certainly becomes less attractive from a purely financial point of view.

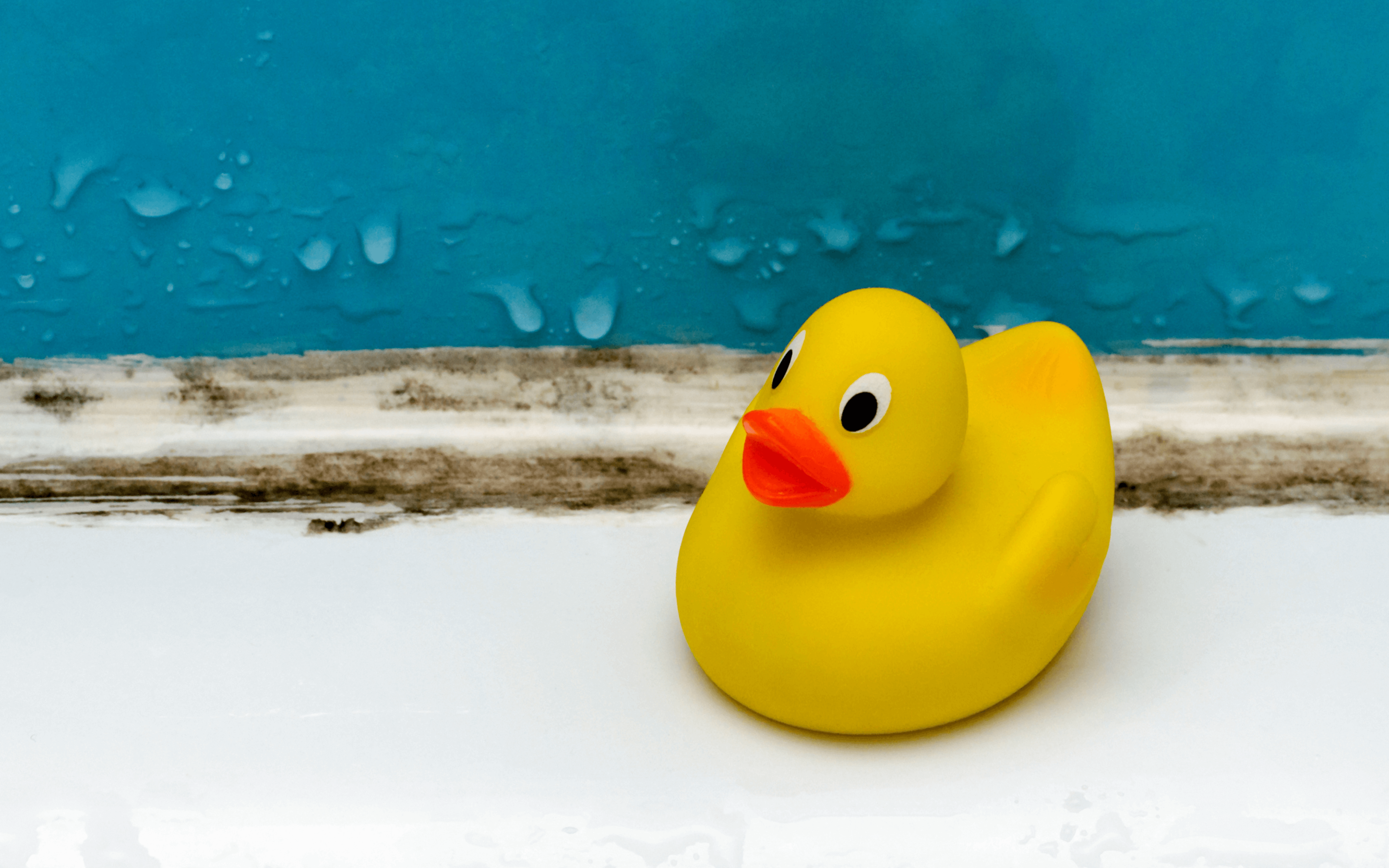

- Pay attention to makeup and such trickeries

The decorations and renovations shows that you may see on several television channels often emphasize the beauty of the finished product. Never lose sight that you are not buying decoration: you are on the market for a building. In other words, you are not looking to buy the content, but the container itself. Take care to look beyond decorative objects, beautiful colors and other such tricks of the trade and focus on what will remain: the location, the surrounding noise, the state of the building, storage spaces, functionality, etc. Also, keep in mind that the building might have undergone a real estate flip (click here or here to read one of our article on the subject) and that all this beautiful finish is there to hide nasty surprises. A savvy investor will immediately see through the tricks and be suspicious.

In summary, when buying your first home, keep in mind that it remains an investment and should be chosen accordingly. A house that doesn’t offer an up-to-date decor but that has been well maintained over the years is a better investment than a neglected building that has been pimped up for sale. Also take the time to think about your decision and surround yourself with competent and impartial professionals who will guide and inform you properly.

Click here to find out about all the benefits of our exclusive pre-purchase inspection program My First Home specially designed for first time buyers!